- QUICKEN WIDGET FOR MAC FOR MAC

- QUICKEN WIDGET FOR MAC SOFTWARE

- QUICKEN WIDGET FOR MAC PC

- QUICKEN WIDGET FOR MAC FREE

If feels like I'm working with a small enterprise that's interested in putting out a superior application, improving it and solving issues and responding to questions. The few times I've had a question about using CountAbout I've always gotten a response by the end of the day - and often in an hour or less. and 38519 rows (as of csv format to Quicken format with csv2qif Convert, by MoneyThumb. It took me awhile to fully embrace it but once I did I've been very happy and would not go back to Quicken even if they offered a fully online version. I wanted something that worked a lot like Quicken and CountAbout fit the bill.

I settled on Tiller and CountAbout and subscribed to both I quickly decided that a spreadsheet is not what I wanted.

QUICKEN WIDGET FOR MAC SOFTWARE

I immediately dismissed any 'free' financial software (Mint, etc.) - I believe that you get what you pay for and there is no such thing as 'free.' 59-60 QuickBooks, 206 Quicken, 206 QuickTime Player, 507-508 editing in.

QUICKEN WIDGET FOR MAC PC

The replacement had to be online available from my phone, tablet, etc., and no software installations almost every year. 35 exiting, 559 finding restarting, 14 Mac equivalents of PC programs.

QUICKEN WIDGET FOR MAC FOR MAC

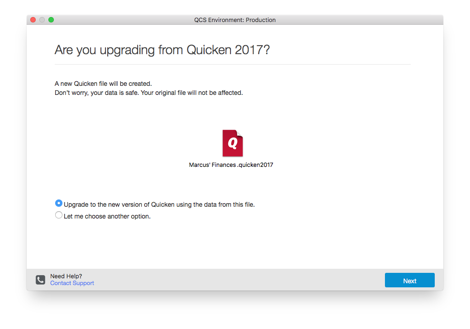

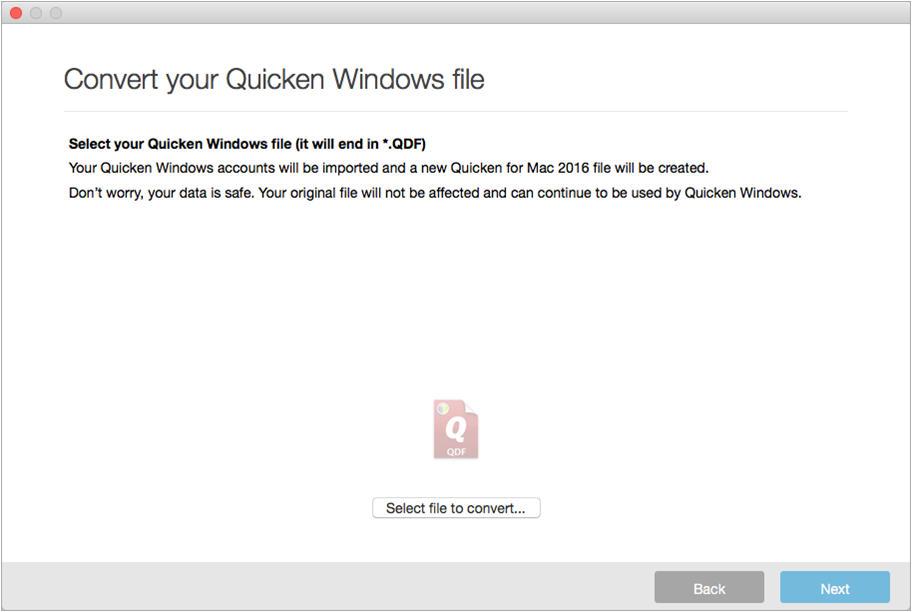

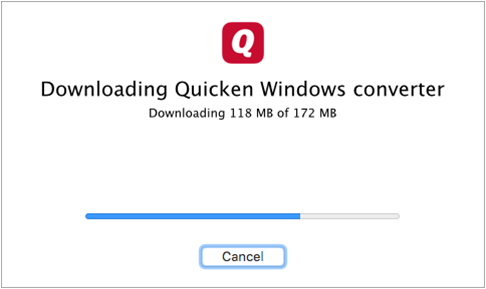

I'd been using Quicken for Mac for 10+ years and wanted to migrate to using a Chromebook instead of a Mac, to do that I had to find a replacement for Quicken. This partnership will create programs that will open the door of homeownership to many of America’s families.I'm a one-person real estate brokerage and having accurate financial records and being able to easily search transactions and generate reports is crucial. Homebuyer demographics will continue to significantly shift in upcoming years, and mortgage programs must evolve to serve the needs of groups like first-time buyers and minority groups. I agree about old computers, like i used to work on a 2012 mac. “Quicken Loans is committed to helping qualified clients achieve their dreams of owning a home. “Today’s announcement marks one more way Freddie Mac is engaging with its customers to help them innovatively build stronger businesses and a stronger housing finance industry that expands affordable housing opportunities for America’s families.”Īttribute to Bill Emerson, Chief Executive Officer, Quicken Loans: We then hope to use the results from these efforts to make it easier for all of our customers, and the industry, to make successful homeownership possible for a wider range of qualified borrowers.” We are leveraging our unique strengths to explore simple straightforward approaches to mortgage products, technology and borrower outreach strategies. The 2007 edition of the software added a QuickEntry Dashboard widget while the 2006 version added a Smart Payee feature. If you send us your data file we will do some of the conversion for you and send you back a file ready to be used in Quicken for Mac 2015.

QUICKEN WIDGET FOR MAC FREE

We offer a free service to help with the conversion process. “We are proud to join Quicken Loans in a new partnership dedicated to increasing homeownership opportunities and simplifying the process of originating and delivering high quality mortgages. Here is direct quote from Quicken tech support: Converting from Windows to Mac often takes a long time and can be complex. The new Freddie Mac/Quicken Loans partnership was announced at the Mortgage Bankers Association’s 102nd Annual Convention and Expo in San Diego, CA.Īttribute to Dave Lowman, Executive Vice President, Single Family Division, Freddie Mac: It’s also been rewritten a couple of times to work better within the limitations of the Apple iOS. It’s actually a completely different product than it’s Windows counterpart. Home Possible enables eligible borrowers to finance a house with a down payment of as little as three percent, according to Freddie Mac. Quicken for Mac is a native app for Apple iOS. It will explore numerous modifications and expansions to Freddie Mac’s current Home Possible mortgage products, and will also include continued homebuyer education.

The program will feature unique, co-developed products to meet the needs of emerging markets, including millennials, first-time homebuyers and middle-class borrowers. The FINANCIAL - Freddie Mac and Quicken Loans, the nation’s second largest mortgage lender, on October 19 announced a partnership to pilot several new initiatives aimed at helping provide more Americans the opportunity to achieve homeownership, while also building a smarter American mortgage finance system.

0 kommentar(er)

0 kommentar(er)